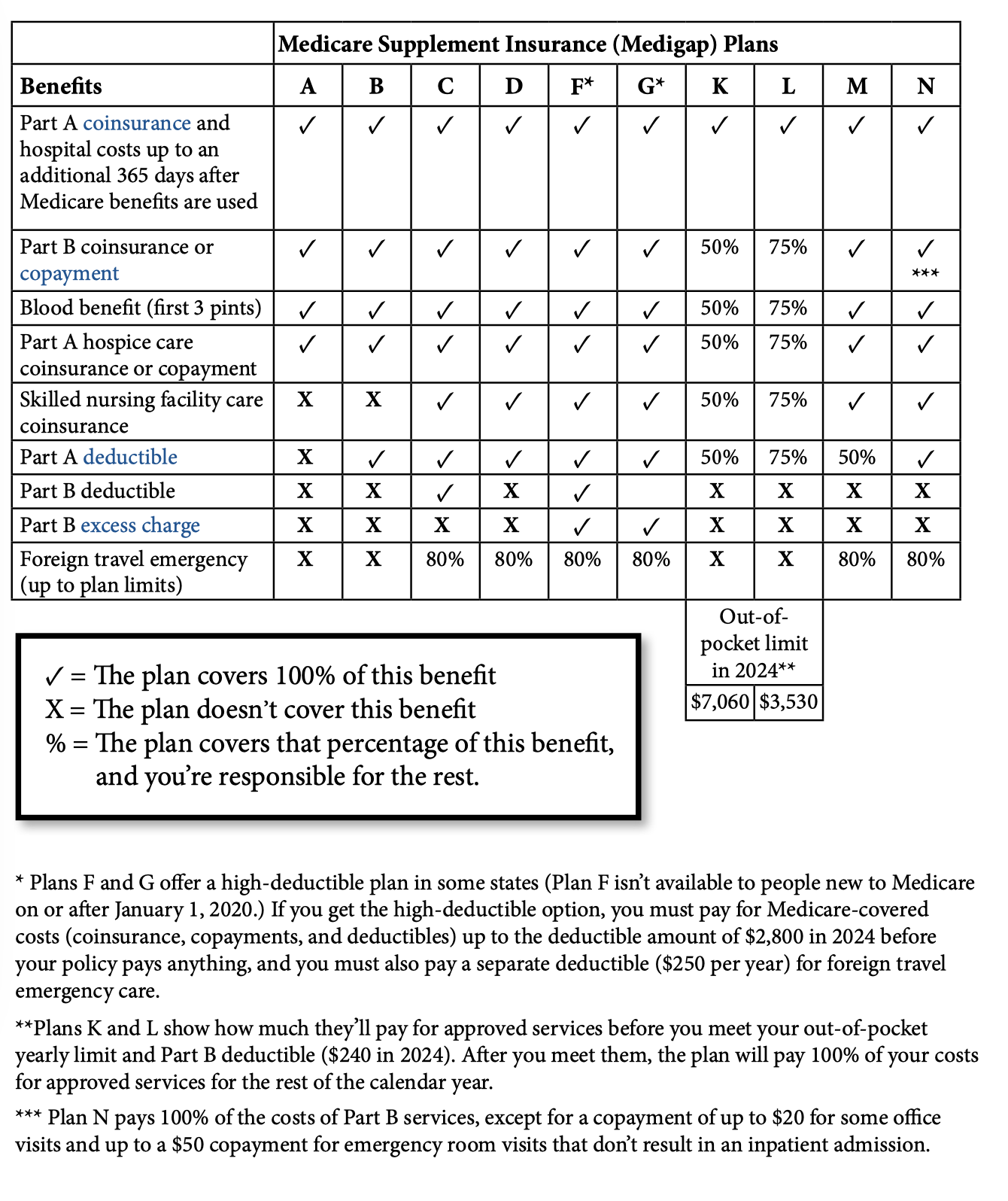

This chart shows general information about 10 currently available Medigap policies. The percentages shown are what each policy covers. The rest is your responsibility.

Medicare Supplement is just what the name implies.

Original Medicare is the federal health care program that pays for a lot, but not all, of your medically necessary treatments, services, and supplies.

- Keep in mind, there are “gaps” in Medicare coverage -like deductibles, copays, and coinsurance.

Medicare Supplement is ancillary or secondary coverage, approved by Medicare, issued by private companies, that help cover the “gaps” in Original Medicare coverage.

- Medicare Supplement Plans are also called Medigap policies.

- Some Medigap policies include certain benefits beyond basic Medicare:

- such as limited emergency medical expenses while traveling abroad.

Note: Medicare doesn’t pay any part of the premium for Medigap coverage.

Whenever you have Original Medicare and Medigap coverage, Medicare pays its share for approved services -then your Medigap policy will pay its share.

Medigap Issuers’ can only sell “Standardized” Medicare Supplement Plans.

- In other words, each Medicare Supplement must have specific benefits -so, you can easily compare plans issued by different carriers.

Note: Companies that sell Medigap policies don’t have to offer every “Standardized” plan -but, when you apply for coverage during Medigap “Open Enrollment Period” -you’re able to buy any available Medigap policy for the same price as healthy people, even if you have health issues:

- During Medigap OEP you will generally get better prices -and have more plan choices.

- If you apply after Open Enrollment, there’s no guarantee any company will issue you Medigap coverage, unless you have special circumstances.

Bye the way, Medigap policies are different than Medicare Advantage which is another way to have Medicare benefits administered by Medicare approved private companies.

- Medigap policies help cover typical out-of-pocket costs of Original Medicare services, and supplies.

What’s more, Medigap doesn’t coordinate with any other health coverage:

- like Medicare Advantage or Medicare prescription drug plans, employer/union group health coverage, group retiree health plans, Medicaid, TRICARE -or individual health plans, commonly referred to as ObamaCare.

- Furthermore, companies’ aren’t allowed to sell Medigap coverage, to anyone who has any of these coverages.

Medicare Supplement Simplified

Buying Medigap coverage is an important decision only you can make for yourself. While you’re shopping for “your chosen plan” be sure to shop carefully.

- Always keep in mind, “Each company likely charges different premiums for the same exact thing”.

Medigap policies are Standardized by the federal government to protect you,

- And must be clearly identified as “Medicare Supplement Insurance” using letter notations A through D, F, G -and K through N.

- Some Medigap issuers offer a “high deductible” plan F option as well.

Consider these simple steps:

- Choose the benefits you want, then decide which standardized Medigap policy meets your needs. Keep in mind, most insurers don’t offer all the different letter notation plans.

- Find out which carriers offer your chosen plan in your area.

- Working with a local independent agent is important; because local advocates have access to unbiased information to help you recognize which carrier’s premium best fits your budget.

- It’s always easier, buying “your chosen Medicare supplement” during Medigap Open Enrollment Period -because, you won’t have to answer health questions during your Medigap OEP.

Are you aware? Nowadays certain carriers have enhanced underwriting for people wanting Medigap coverage.

- So, even if you’ve recently been turned down -you may qualify for enhanced Medigap coverage.

Important facts related to Medicare Supplement:

- In order to buy any Medigap policy you must have both Medicare Part A -and Medicare Part B.

- Medigap policies only cover one person.

- Spouses must buy separate policies.

- Nowadays Medigap policies are guaranteed renewable, even if you have health problems.

- Meaning insurers can’t cancel your Medigap policy, as long as you stay enrolled in Medicare, pay the premiums on time, and made no misrepresentations on your application.

- Each company may charge different premiums for the same exact benefits.

- Always be sure you’re comparing policies with the same letter notation -for instance, Plan F to Plan F -Plan G to Plan G -and so on, whilst shopping for your chosen plan.

- After January 1st, 2020 Medigap Plans C and F will no longer be available in Texas -but, if you buy one of these plans (that cover the Medicare Part B deductible) before January 1st, 2020 -you’ll be able to keep it -and your benefits won’t change.

- Plans D and G effective before June 1st, 2010 have different benefits than Plans D and G offered nowadays.

- Plans E, H, I -and J are no longer sold; but, anyone who already has one of these old plans can usually keep it.

- Medigap policies sold nowadays aren’t allowed to cover Part D prescription drugs.

- If you want prescription drug coverage you will want to consider joining a Medicare prescription drug plan when your first eligible, or you may have to pay a late enrollment penalty whenever you sign up later.

- You can’t have limited prescription drug coverage, through an old Medigap policy, purchased before January 1, 2006, and be in a Medicare drug plan at the same time.

- If you have one of those old Medigap policies, and want to join a Medicare drug plan, contact the Medigap issuer and have them remove the limited drug coverage from that plan.

Little secrets that affect Medigap premiums:

You’ll pay the private company a separate premium (in addition to the Medicare Part B premium you pay the government) for your Medigap policy.

- It’s important to periodically shop Medigap policies -because, premiums will eventually go up as you get older.

- With most companies, you’ll qualify for household discounts, if there are two policies in the same household.

- Nowadays, a few insurers only require two adults in the home, to qualify.

- Some carriers offer Medigap policies called Medicare SELECT Plans which lower premiums even more.

- If you ever want to drop a Medigap policy, you must contact the issuing company to cancel it.

- It’s important to confirm it’s cancelled.

- Agents are not allowed to cancel the policy for you.

When is the best time to buy Medigap?

It’s always best to buy Medicare supplement coverage during your Medigap Open Enrollment Period, whenever you’re 65 or older, and enrolled in Medicare Part B.

- After your Medigap OEP ends, you may not qualify for Medicare supplement coverage -or you may have to pay more, depending on your health.

If you delay enrolling into Medicare Part B -and keep group coverage at work, or your spouse’s work, your Medigap Open Enrollment Period will be delayed until you sign-up for Medicare Part B later.

What’s more, if you decide to join Medicare Advantage, and feel you’re not happy with your chosen plan during the first year, you’ll have “special rights” under federal law to switch back to Original Medicare and buy Medigap coverage, without answering any health questions.

- You must return to Original Medicare within twelve months of enrolling into Medicare Advantage for the first time.

- If you had Medigap coverage before joining Medicare Advantage, you’ll be able to get your old policy back, if the company still sells it. If your old Medicare supplement is no longer available -you can buy another Medigap policy.

- If you joined Medicare Advantage when you were first eligible for Medicare, you can choose any available Medigap policy.

Again, Medigap policies can no longer include limited prescription drug coverage. So, if your old Medigap policy had limited prescription drug coverage before,

- You’ll need to have the issuing carrier remove the limited drug coverage, if you buy that old policy back now.

- If this happens, you may want to consider joining a Medicare prescription drug plan, if you want Part D coverage going forward.

Also, whenever you have Medicare Advantage, it’s illegal for anyone to issue you a Medicare supplement policy, unless you’re switching back to Original Medicare.

- Keep in mind, if you want to switch back to Original Medicare and buy Medigap coverage -there are specific times of the year when you can disenroll from Medicare Advantage.

One last thing, if you’ve had Medigap coverage for awhile, and have experienced premium increases since you first bought that plan, chances are, you’re paying too much!

- Medicare supplement issuers are always coming-out with new plans to remain competitive in this ever-changing market.

- Medicare supplement is not subject to Medicare Annual Election Period.

- You can apply for a new Medigap policy anytime -issued upon approval.

Our unbiased comparative rater lets you compare premiums in just minutes. Book a quick review online! Call us locally at: 806-350-7380 during normal business hours.